Energy Efficiency | August 13, 2020

Invest Now or Pay Later for NYC Carbon Emissions

As time ticks on, building owners and managers alike in New York City need to assess their carbon footprint. The year 2024 is right around the corner, and without appropriate action, legislators will hit building owners’ wallets with carbon emissions fines in accordance with Local Law 97 of 2019. However, there are ways to avoid these fines, receive incentive money, cut taxes, acquire operational savings and ultimately yield a cleaner environment by the 2024 deadline.

Why not invest in it now instead of paying more for it later?

Background information on Local Law 97

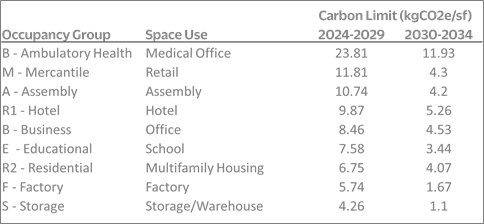

Local Law 97 (of 2019) is one of 10 bills and resolutions passed as part of the New York City Climate Mobilization Act, the single largest carbon reduction effort set forth by any city to date. The law is set to curb emissions by requiring buildings with over 25,000 square feet to lower their carbon output by 40% by 2030 and then by 80% by 2050. Buildings will face compliance fines starting in 2024 and must meet annual carbon intensity limits during each compliance period, initially set from 2024-2029 for the 2030 deadline, based on building type.

Image source: CodeGreen Solutions

If buildings are not compliant with those limits when these time periods begin, they will face a fine that could potentially be costly. That includes an annual $268 fine per metric ton (CO2e) that their carbon footprint exceeds the limit. The carbon emissions limits set include onsite and offsite emissions, so reductions in lighting as well as heating and cooling all contribute to reaching the set standards.

To be clear: by January 1, 2024, buildings over 25,000 square feet have to reduce carbon emissions to the above limits or else face consequences. And 2024 is coming up quick.

Energy efficiency solutions for Local Law 97 compliance

With the goals of the law set in stone, the next four years are pivotal for buildings to meet those goals. Energy audits are a great place to start when determining building needs and what can to be done to be compliant to the emissions standards of the law. Some companies will offer them at no-cost.

An energy audit is a detailed survey of your building’s energy usage that provides a variety of energy-efficient solutions. Audits also provide a snapshot of calculated emission decreases. calculated. From kWh saved, we can determine the actual amount of CO2e reduced. Solutions typically range from lighting retrofits to HVAC, mechanical and building management system upgrades.

Tax deductions and PACE financing for Local Law 97 projects

Finding the capital for these solutions can be a challenge. Some companies may turn to traditional, third-party financing options. However, tax benefits may also be available for those who invest in energy efficient products and services.

The recently renewed 179D incentive (originally part of the 2005 Energy Policy Act) determines the tax deduction achieved from the installation of energy-efficient assets; a participating building may be able to qualify for up to $1.80 per square foot. Partial deductions typically are allowed for lighting upgrades; most commercial property owners who file taxes are likely eligible for the benefit.

The 2019 Local Law 97 also stipulates that certain buildings may be eligible for a Property Assessed Clean Energy (PACE) financing loan for carbon emission reductions with little to no interest; however, the launch of this PACE program has been delayed due to COVID-19, and with the rapidly approaching deadline of 2024, businesses will need to act quickly to ensure loan coverage and avoid the bill’s fines.

Current, available utility incentive funding: take advantage today

Upgrades for large scale buildings can be costly, but to support Local Law 97, ConEdison offers financial aid for impacted building owners in the form of rebate incentives for energy efficiency projects. Currently, they are offering to cover 10-40%+ of these depending on the magnitude of the project.

Keep in mind that these monetary incentives aren’t infinite, so the longer you wait, the greater the possibility of the well running dry. Rebate utility incentives help lower upfront capital costs, increase ROI and drive a project’s simple payback period down.

Investing in your own infrastructure

Implementing energy efficient best practices to your building yields savings. Our average customer saves over $200,000 annually with a payback of roughly 2.5 years. Depending on the size and specifics of your building’s efficiency upgrades, acting now could ensure that your project will be completely paid off by the time Local Law 97 compliance mandates go into effect.

This blog post is part of a multi-post series surrounding the new legislation Local Law 97, affecting thousands of buildings and businesses across New York City. This series aims to look at multiple viewpoints on the new law and how it can affect your business, as well as how you can work to avoid noncompliance fines by acting today.

More information about Local Law 97:

Related Posts

Discover more content and insights from Mantis Innovation

The Cost of Inaction: Why Businesses Should Act Now on Energy Efficiency

In today's fast-paced business environment, the financial and operational losses businesses incur by delaying energy efficiency improvements, the "cost of inaction," is more relevant than ever.

In today’s AI era, human intelligence is the key to data center facility and energy optimization

Nowhere else in modern industry do artificial and human intelligence converge with such transformative potential as in the world of data centers. As AI's extraordinary growth accelerates demand for

Your Guide to LED Lighting for Business and Commercial Buildings

Never to be underestimated, LED lighting and well-designed lighting retrofits and upgrades offer businesses big improvements like reduced energy costs, reduced emissions, and improved working

Five Trends Driving Data Center Facility Energy Optimization

Today’s digital economy, commercial and industrial digitalization, and the recent explosion in artificial intelligence and machine learning (AI/ML) powered computing are driving massive growth in