Energy Procurement | March 18, 2024

Electrification’s Increased Demand on the U.S. Electric Grid

A Slight Increase in Energy Demand for 2024

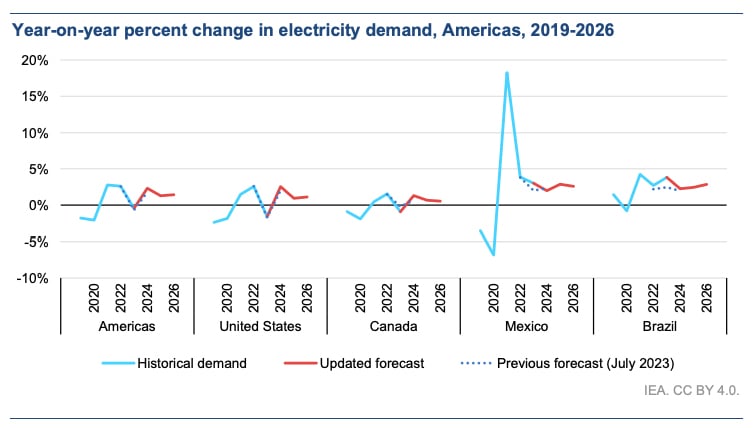

Although the US economy expanded at an annualized rate exceeding 3% in the initial three quarters of 2023, peaking at 4.9% in the third quarter, the demand for electricity fell by 1.6% over the year. This was in contrast to the 2.6% growth observed in 2022. The decrease in electricity consumption can be attributed to the relatively milder weather experienced in many regions of the country during both the summer and winter months of 2023, which led to a reduction in the need for heating and cooling.

Despite last year's decrease in demand due to mild weather, the U.S. is projected to see a 1.5% annual growth in electricity usage from 2024 to 2026. This growth is anticipated to be fueled by an upsurge in manufacturing and the electrification of the transportation and building sectors, as per a recent report by the International Energy Agency (IEA).

The IEA’s annual electricity report predicts that around one-third of the additional demand will be generated by the rapidly expanding data center sector.

The expected growth in demand is partly attributed to the Inflation Reduction Act and the bipartisan infrastructure law, which provide incentives for energy-saving electric appliances like electric heat pumps and water heaters.

In September, for instance, the Biden administration and governors from 25 states unveiled plans to increase the number of heat pumps in U.S. homes to 20 million by 2030, up from 4.7 million, as reported by the IEA.

Reflecting on the previous year, the IEA noted a decrease in U.S. electricity usage due to milder winter and summer weather compared to 2022. Additionally, a reduction in manufacturing activity was observed due to inventory drawdowns, automotive industry strikes, and inflationary pressures.

After a 2.2% increase in 2023, global electricity usage is expected to rise by 3.4% annually over the next three years, propelled by growth in China and other emerging markets.

Future Power Generation

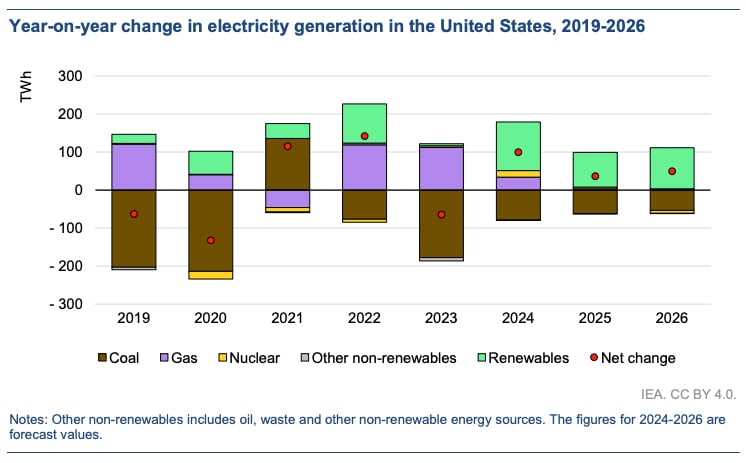

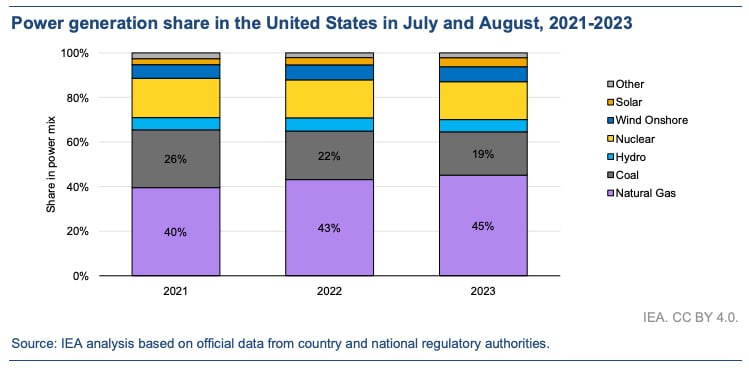

On the generation front, the IEA anticipates U.S. wind and solar production to surpass coal-fired generation for the first time in 2024. Despite financing and supply chain issues causing delays and cancellations of some U.S. projects, particularly offshore wind, installations of wind and solar are projected to boost renewable generation by around 10% annually from 2024 to 2026.

The IEA predicts a nearly 10% annual decrease in U.S. coal-fired output through 2026 due to ongoing power plant retirements, albeit at a slower rate than the past two years. Gas-fired generation is expected to remain relatively stable over the three-year period starting this year.

With the rise of renewables and the decline of coal generation, the IEA anticipates that U.S. power sector carbon emissions and emissions intensity will decrease at annual rates of 4% and 5%, respectively, between 2023 and 2026.

Key Takeaways

Energy Efficiency: Electrification can lead to increased energy efficiency, especially when paired with energy-saving appliances like electric heat pumps and water heaters. This could result in lower energy costs in the long run.

Environmental Impact: Electrification, particularly when powered by renewable energy sources, can significantly reduce a building’s carbon footprint. This aligns with global sustainability goals and can enhance the building’s reputation.

Incentives: The Inflation Reduction Act and the bipartisan infrastructure law provide incentives for energy-saving electric appliances, which could offset the initial investment costs.

Increased Electricity Demand: The projected growth in electricity usage could lead to higher energy costs, impacting the operating expenses of the building.

Upfront Costs: The transition to electric appliances and systems may require significant upfront investment, which could be a financial burden.

Dependency on Grid: Electrification increases dependency on the electric grid. Any instability or power outages could disrupt building operations.

It’s important for facility owners and operators to carefully consider these factors and potentially seek professional advice when planning an energy strategy.

For more details, refer to the full report: Electricity 2024: Analysis and Forecast to 2026.

Related Posts

Discover more content and insights from Mantis Innovation

The Cost of Inaction: Why Businesses Should Act Now on Energy Efficiency

In today's fast-paced business environment, the financial and operational losses businesses incur by delaying energy efficiency improvements, the "cost of inaction," is more relevant than ever.

Navigating Energy Procurement: Strategies to Manage Risk

When procuring energy for your commercial business, it can be difficult to weigh the risks associated with buying strategies. How do you know your procurement strategy is the right one? How

6 Facts about Energy Services in Efficiency Projects

As a nationwide firm with design/build capabilities, we identify, design, and deliver efficiency projects for clients across the United States. These projects are rooted in several core energy

PJM Capacity Auction Results: A Surge in Prices and Its Implications

PJM recently released the capacity auction results at the end of July for the period of June 2025 through May 2026, and the outcomes have been much higher than most anticipated. This surge in prices