Sustainability | May 17, 2023

Building performance standards are on the rise. Is your portfolio ready?

This blog is the first in a three-part series exploring how investing in sustainability now will help protect your business from mounting facility-centric risks: the swift rise of building performance regulations, increasing energy costs, and the high costs of a run-to-fail approach to operations.

By this time next year 20% of U.S. building stock will likely be subject to energy performance requirements. This fast-moving regulatory trend poses a near and present threat to businesses across the country—but also an opportunity to gain a competitive edge.

In many cities across the U.S., buildings account for up to 50%-75% of city-wide greenhouse gas emissions—and building owners are feeling the heat to bring their contributions down.

That pressure is about to get more intense as the nation works to slash emissions by 50%-52% from 2005 levels by 2030. Already a Federal Building Performance Standard (BPS) has been set to electrify 30% of federally-owned building square footage by 2030.

But federal leaders aren’t the only ones laying out performance regulations.

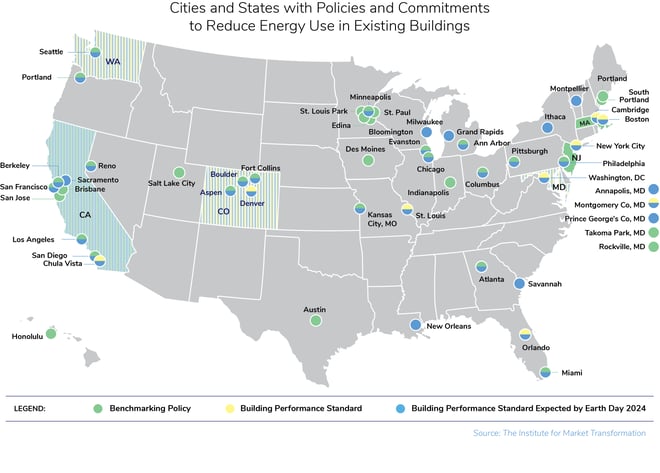

Cities and states across the U.S. are moving the needle toward decarbonization by requiring their own sets of emissions reduction standards.

State and local governments racing toward regulation

Right now a group of over 40 (and counting) state and local governments have committed to rolling out energy/emissions performance improvement requirements for buildings and other commercial and multifamily facilities by 2024. That’s according to the National BPS Coalition, a program launched by President Biden and facilitated by the Institute for Market Transformation (IMT).

Each jurisdiction has unique policies, but they generally fall into the following categories:

- Energy benchmarking and transparency

You can’t manage what you don’t measure, as the saying goes. Right now nearly all BPS members have passed policies requiring buildings to track and share energy performance data on a regular basis.

Energy benchmarking policies play a crucial role as a foundational step towards creating awareness about energy performance and driving deeper energy reductions by providing a standardized framework for measuring and comparing energy usage across buildings and industries. - Prescriptive requirements like an energy audit and tune-ups

Audit and tune-up policies take a deeper dive into facility energy performance and provide recommendations to encourage facility owners and operators to make reasonable upgrades when possible.

For example, Seattle’s Building Tune-up ordinance identifies low- or no-cost actions related to building operations and maintenance. Non-residential buildings of more than 50,000 square feet must comply with the requirement every five years—which means not only identifying tune-up opportunities but executing some or all of them as well.

Atlanta, Georgia requires energy audits every 10 years for commercial buildings 25,000 square feet or larger. And the city of Austin, Texas, requires energy audits and disclosures for all buildings within city limits.

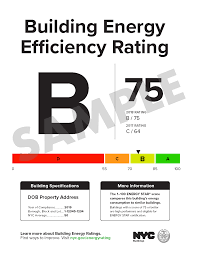

Meanwhile in New York City buildings get letter grades based on their energy efficiency performance, while in Chicago, performance is rated with one to four stars, with four being the highest performers.

efficiency performance, while in Chicago, performance is rated with one to four stars, with four being the highest performers.

These types of policies play a role in accelerating energy reductions and preparing building owners for deeper action that’s required to meet the necessary climate goals set. - Building performance standards in place

Several cities have laid out building performance standards based on emissions, others on energy use, and yet others on the EPA ENERGY STAR 1 -100 score, according to IMT data.

In New York City, building owners get specific carbon emissions limits for commercial and multifamily buildings (25,000+ square feet). Here, if your building exceeds its annual carbon emissions limit, you may be fined as much as $268 for every tCO2e/square foot by which you exceeded the cap.

In Chula Vista, California, buildings sized 20,000 square feet and up must have a verified ENERGY STAR Score of at least 80; or be ENERGY STAR certified; or be LEED Existing Building Certified for three of the last five years.

In St. Louis, municipal, commercial, institutional, and multifamily buildings 50,000+ square feet must meet site energy use intensity requirements.

Increasing regulatory change poses risk — and opportunity

By Earth Day 2024, we expect 20% of U.S. building stock to be subject to such standards mentioned above. While the commitments vary by jurisdiction, the trend is toward more, not less regulation in our most populated cities.

This means building owners and portfolio managers need to get a head start on managing regulatory risk, which can include:

- Fees/fines if you don’t meet performance requirements. Also of note: fees/fines will become more stringent over time; the later you start making plans and implementing change, the higher the cost may be.

- Negative impacts to scores from ESG rating systems—and in turn, ESG strategy and reputation.

For example in the GRESB rating system, you get points for how well your buildings perform from energy, water, and waste. So even if you’d paid your financial dues in the form of a fine, you still risk performance in benchmarking systems that can negatively impact brand reputation.

Fortunately mitigating these risks also means uncovering new opportunities.

By embracing building performance benchmarking and standards, you can optimize energy use and spend, support ESG strategy, and improve brand reputation.

Like most proactive sustainability measures, embracing building performance strategy can align with and accelerate your business goals—from lowering operating costs to increasing property value.

It’s time to plan for a new era of building performance

Over the next 12 months, building owners have a vital window to reduce risk, and embrace opportunity.

By deliberately taking the above-mentioned risks into account during your investment decision making investing strategically in current development, renovation, and system replacements you can significantly reduce financial risk while ensuring long-term facility value.

The best place to start is with a portfolio-wide analysis of the energy and asset condition performance of your buildings. With current energy performance insights as a baseline, you can use operating measures such as controls tune-ups to address low-hanging fruit for quick wins across your portfolio. From there look to capital measures such as major systems upgrades and renewable energy to hit the long-term goals cities are setting for building decarbonization.

The regulatory tide is turning as more cities and states work to address climate change—a trend that will only accelerate in the coming years.

Learn how a Mantis Innovation expert can help your facilities get ahead of the regulatory risk curve.

And stay tuned for the next topics in the risk series: energy cost risks (2) and operational risks (3).

Related Posts

Discover more content and insights from Mantis Innovation

Carbon Credits Explained: A Primer for Achieving Your ESG Goals

In the race to achieve net-zero emissions, carbon credits have become a crucial tool for companies with hard-to-abate emissions. As of 2024, almost half of the Fortune 500 companies have net zero

Five Trends Driving Data Center Facility Energy Optimization

Today’s digital economy, commercial and industrial digitalization, and the recent explosion in artificial intelligence and machine learning (AI/ML) powered computing are driving massive growth in

Modernizing Manufacturing Facilities: Practical Steps for Better Performance

In today's competitive manufacturing landscape, staying ahead requires more than maintaining the status quo. Modernizing facilities and operations is essential for improving efficiency, performance,

Modernizing Manufacturing Facilities: The Drivers and Direction

This blog is just a glimpse into the deep dive we take in our new white paper, Modernizing Manufacturing. Download the white paper here to skip the teaser and get the whole story. The stage is set