Energy Procurement | October 27, 2021

Energy Risk Management

Much like your suitcase after a trip away, energy risk management can feel messy. How do you know your strategy for purchasing energy is the right one? How much risk should you weigh? How much time do you have to track the energy market, and if it’s not your primary job function, do you have resources to help? All of these questions lead us to sort through what energy risk management means. When we refer to energy risk management, we mean making smart choices about energy procurement, taking into consideration the needs of your company and facilities. Remember: risk doesn’t mean bad things will definitely happen, but it does impact buildings, facilities, and an energy market that are constantly changing. Risk management means navigating the unknown that comes along with that change.

What energy risk management means for businesses today

The market rises and the market falls. When supply is high and demand is down, you probably saw lower energy bills. But when demand creeps up (cold winter/hot summer months, return to the office post-pandemic, etc.) and supply dwindles down as a result, those prices are going to rise. What does this mean? That’s where energy risk management comes into play. There are many ways to customize your energy procurement strategy that mitigate whatever level of risk you’re comfortable managing.

3 ways to think about energy risk management

It’s often helpful, as with many complex concepts, to think about risk management in other terms. Here are some analogies to help “unpack” what energy risk management means.

1. Managing your energy spend like your stock portfolio

1. Managing your energy spend like your stock portfolio

We can sum it up in a word: diversify! Investopedia explains, “…since we can never be sure of what the market will do at any moment, we cannot forget the importance of a well-diversified portfolio in any market condition.” This means selecting stocks and investment opportunities across a variety of asset classes. Diversification blends different investments in one portfolio – and energy risk management can work exactly the same way. You, too, can select different contracts, suppliers, rates, or purchasing strategies across your portfolio of buildings and properties to create balance and better budget predictability.

2. Choices about health impact risk

2. Choices about health impact risk

This second analogy is one we’re all familiar with. You’ve probably heard it from your doctor: less booze and more salads and exercise mean improved cholesterol, blood pressure, and overall health. These outcomes depend on initial choices: the double bacon cheeseburger for lunch or some leftover stir fry from home? Back-to-back football games on a Sunday afternoon or taking the dog out for a lengthy stroll? Your choices have a direct impact on whether you are at higher or lower risk for various health concerns. Similarly, the choices you make about energy procurement will directly impact costs over time for your utility bills and making informed choices today can set you up for better overall facility management tomorrow.

3. Visualize your energy options like a jump rope

3. Visualize your energy options like a jump rope

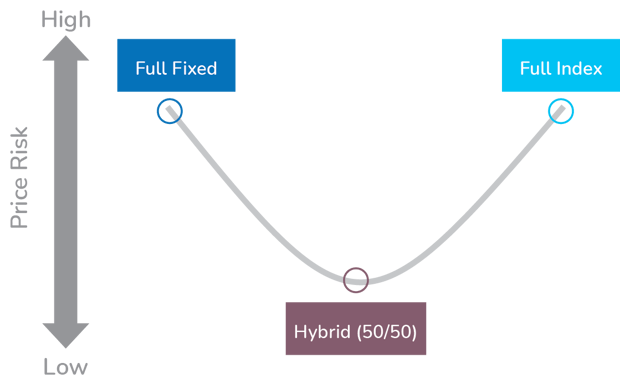

Another way to think of it is to envision a jump rope with one endpoint being a fully fixed solution and the other endpoint being a fully index solution. These two points represent an equal amount of price risk depending on what the market does. The fully fixed strategy locks in a rate based on future prices of a period that hasn’t happened yet, which is beneficial if future prices were to rise, but detrimental if future prices were to fall. The fully indexed strategy sits on the other end of the spectrum: it’s good if future prices were to decline, but not the best performer if future prices were to rise. As you move down the rope the mix of fixed and index changes with the center being a 50/50 mix of index and fixed. Having a mix of these solutions is the equivalent of diversifying your energy portfolio. Obviously however, this is a very simplistic way of thinking about it and there are many additional components to consider, which is why you need an energy expert on your side.

Examples of energy risk management strategies

As discussed, there are a couple key strategies that may or may not be useful to your business. Here’s the high level, but know that we can get as nuanced as needed to meet the needs of your facilities at the point at which you’re locking in your next energy contract.

Energy Procurement Fixed Rate Solution

The Fixed Price Solution gives businesses the safety and security of obtaining an all-inclusive per-kWh price for a set contract term. This approach can function as a hedge against volatile energy markets. It is a simple solution for companies seeking cost stability and budget certainty – but it also locks in a price that won’t change, even if the market dips down later on during the contract cycle.

Energy Procurement Index Rate Solution

At the other end of the spectrum, an Index Price Solution offers the flexibility of pricing that reflects wholesale market conditions. This approach includes the ability to make adjustments when the market drops. However, it can leave businesses who don’t have the time or expertise to keep up with the market in a difficult spot if the market suddenly rises. You could potentially get hit with soaring costs.

Energy Procurement Hybrid Rate Solution

A blend of both worlds, a Hybrid Hedging Solution is a customized mix of fixed and index-based contracts. This type of solution is designed to mitigate the risk of buying either a fully fixed or an index based energy product. This strategy can provide you with a diversified way of managing their long-term energy spend within your risk tolerance.

Energy procurement isn’t one-size-fits-all

The more risk you have to consider in today’s energy markets, the more this statement is true. While certain types of business may fit a similar profile for energy procurement, all companies should work with experts in the energy market to determine the right balance of energy contracts to meet their needs. Your business is no different! Be sure you have trusted sources available and choose the right energy broker to help create an energy procurement strategy and lock in contracts with the suppliers that make the most sense for you, your goals, and your appetite for risk.

Related Posts

Discover more content and insights from Mantis Innovation

The Cost of Inaction: Why Businesses Should Act Now on Energy Efficiency

In today's fast-paced business environment, the financial and operational losses businesses incur by delaying energy efficiency improvements, the "cost of inaction," is more relevant than ever.

In today’s AI era, human intelligence is the key to data center facility and energy optimization

Nowhere else in modern industry do artificial and human intelligence converge with such transformative potential as in the world of data centers. As AI's extraordinary growth accelerates demand for

Power Shift: Energy Insights Post-Election

A new president has been elected, and while conversations are swirling about tariffs and drawbacks in sustainability initiatives, it is important to understand what effects the administration change

Navigating Energy Procurement: Strategies to Manage Risk

When procuring energy for your commercial business, it can be difficult to weigh the risks associated with buying strategies. How do you know your procurement strategy is the right one? How