Energy Procurement | October 17, 2023

Navigating Winter Storms, El Niño, & Energy Prices: Are You Prepared?

Winter is quickly approaching, but what’s on our radar are the recent forecasts that are showing significantly more snow than last year in many of the major markets. We have known for a while there is expected to be a strong El Nino that lasts through the winter and into the spring, and while it’s still too early to know exactly what that will mean for each region of the country, what we do know is that there could be implications for energy prices, as weather events tend to alter both the demand and supply of electricity and natural gas. El Nino forecasts for the 2023-24 winter season have even shifted in recent months, moving from a warmer and wetter forecast to one currently calling for more snow than last year for many regions.

We will dive into the relationship between winter weather and electricity and natural gas prices, along with the added influence of the El Niño phenomenon and the unpredictability of weather events. More importantly, we’ll delve into strategies to minimize risks and ensure your business is prepared for any winter weather scenario and the associated impact on electricity and natural gas. As always, a proactive approach is wise, but let’s dig further into the factors at play first.

Winter Weather and Energy Demand

Winter weather events, such as storms or extreme cold, can have a significant impact on the demand and supply of electricity and natural gas. Increased demand during winter can strain energy supply networks, leading to higher prices and potential supply shortages. Snowfall, in addition to its direct impact on infrastructure, can prolong cold weather, leading to increased energy consumption. Storms, particularly those that disrupt power generation, can create supply shortages precisely when demand peaks, causing energy prices to spike. Factors that come into play include:

- Unpredictability: While long term seasonal forecasts that include factors like El Niño provide initial indications of weather patterns, forecasting precise effects on specific regions remains challenging. It's only closer to the date that other factors can be forecast and considered, and analog years can be analyzed to refine forecasts.

- Historical Insights and Lessons: While weather can be fickle and unpredictable, historical data can provide valuable insights into how winter weather has impacted energy prices in previous years. Events like Winter Storm Uri in February of 2021 highlighted the potential for extreme price spikes during cold snaps.

- Storage Implications: Colder temperatures necessitate more heating, increasing demand for natural gas. The transition from injection season to withdrawal season can also impact storage levels, influencing future year prices. Storms, particularly those that disrupt power generation, can create supply shortages precisely when demand peaks, driving energy prices to spike.

- Supply and Demand: The balance between demand and supply determines the price of electricity and natural gas in the wholesale market, which then affects the retail prices that consumers pay. Higher demand or lower supply leads to higher prices. However, there are other factors that can influence energy prices, such as storage levels, transmission capacity, fuel costs, regulations, and market competition. So, while weather is not the only driver of energy prices, it can be a significant one.

El Niño's Role in Winter Weather

El Niño, part of the El Niño-Southern Oscillation (ENSO), leads to the warming of Pacific Ocean waters. This climatic phenomenon can significantly influence global weather patterns, including winter conditions.

However, it’s important to keep in mind that not all El Ninos are the same. For example, a strong El Nino in 2015-2016 led to an unusually warm winter for the US mainland, but still included a deadly blizzard in the East Coast. The 2018-2019 season included above average temperatures for the East, with snow and ice from Texas to the Carolinas early in the winter season.

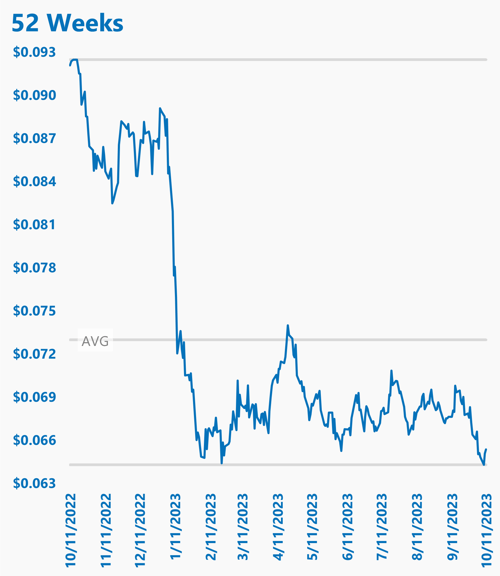

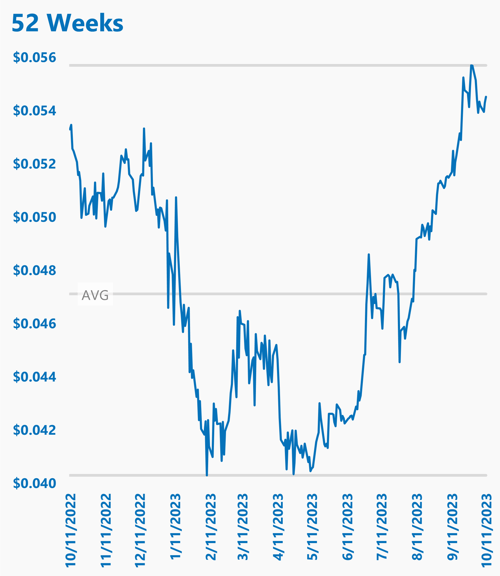

Last year’s winter forecast factored in a La Nina weather pattern, which called for an unseasonably cold and snowy season in the Northeast, leading to price increases in the fall of 2022. However, we saw unseasonably warm temperatures with minimal amounts of snow in most market regions, which led to prices falling as the warmer winter played out (as exemplified in the ISO-NE chart below. Or, consider ERCOT pricing, where we saw prices increase this past summer and fall when heat waves rolled through, increasing demand across the region (shown below in the ERCOT chart).

ISO-NE Internal Hub ATC DA Wholesale Calendar Year 2024

Week to Week Fluctuation ($/kWh)

ERCOT Houston Load Zone ATC RT Wholesale Calendar Year 2024

Week to Week Fluctuation ($/kWh)

What to Expect

While no one has a crystal ball as to where the weather OR energy prices will ultimately land, AccuWeather warned in early October that a strengthening El Niño could make this winter different than last year in part of the United States. It will be colder with plenty more snow for millions of people who live in major cities, but that won’t be the case everywhere.

For example, AccuWeather long-range meteorologists forecast 38-44 inches in Boston, 18-26 inches in New York City and 16-24 inches in Philadelphia -- all around the historical average but a stark contrast from the 2022-23 snowfall, where Boston accumulated just 12.4 inches, New York City 2.3 inches, and Philadelphia 0.3. AccuWeather also warns that a tumultuous weather pattern may unfold over the Southeast. However, there are a variety of factors that contribute to El Nino analysis. Think of it as an initial indication of the broader weather pattern, and then as we get closer to that date other factors start to impact forecasts. Again, a proactive approach to electricity and natural gas supply contracts can minimize budgetary risk. Even better, utilizing a trusted advisor to keep their finger on the pulse of the markets for you.

Strategies for Minimizing Risk

A region's susceptibility to price spikes hinges significantly on the frequency of winter storms it encounters. If a locale experiences a substantial number of these events, it can drive up monthly energy prices. However, accurately forecasting these occurrences often remains feasible only about two weeks in advance, emphasizing the importance of proactive, pre-established strategies to navigate the volatile energy market effectively, including:

- Advanced Planning: It's crucial to have a procurement strategy in place before winter arrives. A fixed adder contract can provide stability in a volatile market.

- Consultation and Monitoring: Enlisting the services of energy experts can help you stay informed as forecasts develop. Quick pricing decisions can prevent chasing a rising market, as witnessed in ERCOT during the summer.

- Locking In Opportunities: For markets currently at 52-week lows, consider locking in a percentage of your load, such as 25%, 50%, or 75%, if not fully fixing in. These strategies can help hedge against potential price spikes.

Next Steps

Winter weather events and their impact on energy prices are complex and interconnected, but it doesn’t have to result in unwelcome spikes in your energy costs. It is prudent for businesses to be proactive in their approach, considering historical data, forecasts, and procurement strategies to minimize risk and ensure stability in an ever-changing energy landscape. By understanding the factors at play, you can be better prepared to navigate the challenges of winter and make informed decisions that protect your bottom line.

Related Posts

Discover more content and insights from Mantis Innovation

The Cost of Inaction: Why Businesses Should Act Now on Energy Efficiency

In today's fast-paced business environment, the financial and operational losses businesses incur by delaying energy efficiency improvements, the "cost of inaction," is more relevant than ever.

In today’s AI era, human intelligence is the key to data center facility and energy optimization

Nowhere else in modern industry do artificial and human intelligence converge with such transformative potential as in the world of data centers. As AI's extraordinary growth accelerates demand for

Power Shift: Energy Insights Post-Election

A new president has been elected, and while conversations are swirling about tariffs and drawbacks in sustainability initiatives, it is important to understand what effects the administration change

Navigating Energy Procurement: Strategies to Manage Risk

When procuring energy for your commercial business, it can be difficult to weigh the risks associated with buying strategies. How do you know your procurement strategy is the right one? How